Late last week, the American Bar Association Journal reported that “most law students earn less money per year after graduation than the amount they borrowed for law school.” This is based off data recently released by the U.S. Department of Education. The article goes on to share that graduates from only 11 law schools reported higher median first-year earnings compared to median federal debt for graduates in 2015 and 2016. Further, the median debt-to-income ratio among law schools is 1.86, which means that graduates took out a median of 86 percent more in loans during law school than the median amount received in their first year working after graduation; median debt upon program completion for graduates was about $110,000 and median first-year earnings were about $53,000.

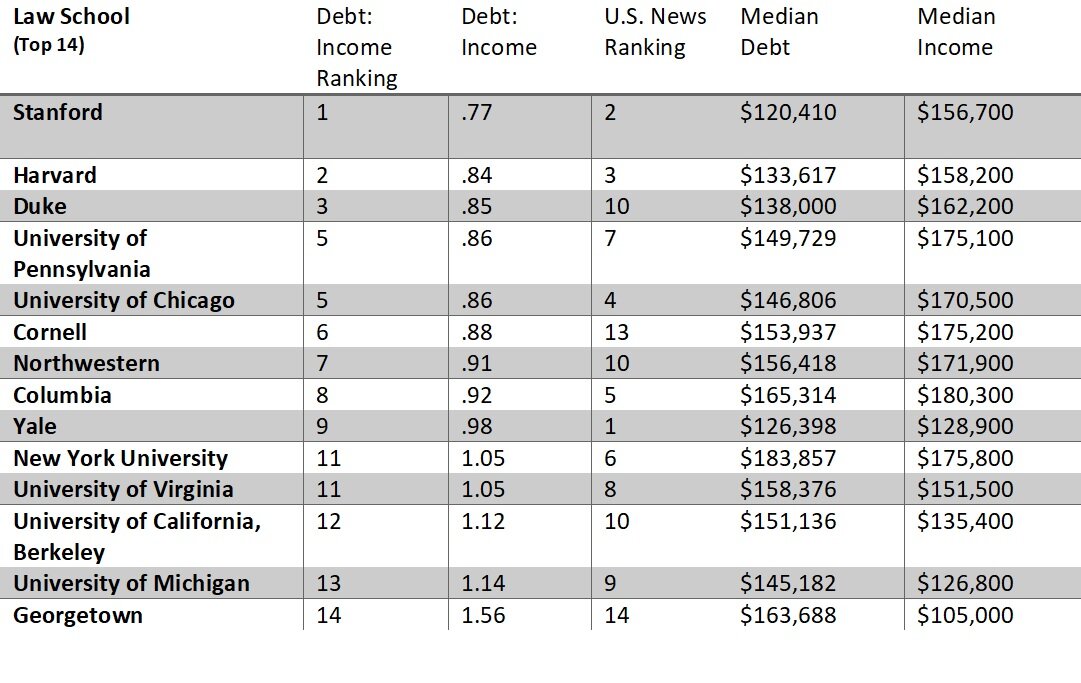

Using the same Department of Education data, Law.com published a debt-to-earnings ratio for the U.S. News and World Report’s Top 14 law schools, as well as for New York-based law schools. We have compiled the data into some charts below for both the top-ranked, as well as NYC-based schools. They show the debt-to-income ratio, median first-year earnings for graduates, and median federal debt incurred for 2015 and 2016 graduates. It is important to note that these data points do not include private loans, loan interest, or borrowing for undergraduate or other graduate programs. So, the ratios may show slightly more positively than the full debt-load that many law school graduates are facing.

If you are considering law school, and you will be paying your own way through federal or other loan programs, you will want to assess this data during your school selection period. Ultimately the program that will best fit your needs should balance strong academic rigor and meaningful experiential learning opportunities with your future debt burden. The debt-to-income ratio rankings, as you can see, do not line up exactly with the school’s academic rankings, and the median debt and median earnings should be one of the many factors in your decision-making process. Additionally, these figures may provide insight into how much time you will want to spend researching fellowships and scholarship opportunities that can also ease the total cost of your schooling, particularly if you’re interested in pursuing lower paying career paths, such as public interest law.