Technology is changing. And so are the demands of the leaders and professionals in the field. Recently, zdnet, a technology-focused news and research site, published an article describing the changing demands of leaders and employees in technology. No longer, the article states, is technical proficiency enough. Technology can no longer exist as a stand-alone function, but must be thoroughly integrated into the business. And tech practitioners must be able to take a broader perspective that includes a thorough understanding of other business functions and how technology fits in amongst them to drive the organization’s mission. “It's important to start to learn about finance, business processes, and other strategies that make up how your product or solution comes full-cycle for your organization," said Nag Vaidyanathan, Chief Technology Officer at Duck Creek Technologies. "How you collaborate with other functions is critical to the results you can achieve."

Haluk Saker, a Senior Vice President at Booz Allen Hamilton, notes that the speed of technological change is such that professionals and managers need, "…problem-solving skills versus language-specific skills. IT professionals should focus on learning, disrupting the status quo, and continuing to gain skills across different domains that interest them. This type of professional, with an innate curiosity and an aptitude to grow as a leader and influencer, is the one that will be able to face tomorrow's toughest challenges head-on," he said.

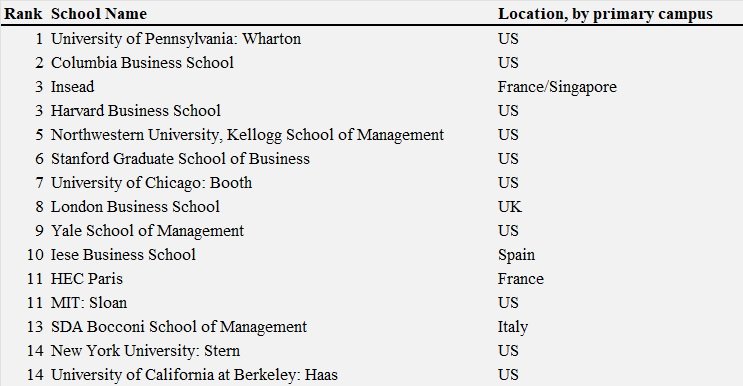

MBA programs are at the forefront of understanding transformation in the technology industry and a number of leading schools (noted below) now offer shorter, and more focused Tech MBA programs. They include core requirements in technology, in addition to typical MBA requirements in general management and leadership.

Johnson Cornell Tech MBA: This is a one-year MBA conferred by the Johnson Graduate School of Management. Graduates will have a full understanding of the startup and tech ecosystems, and will be prepared to manage product teams, and lead tech companies.

NYU Stern Andre Koo Tech MBA: This is a one-year STEM-designated MBA program conferred by NYU Stern. Graduates will be qualified to join startups and mature tech companies at the forefront of innovation and technology, and will be prepared to accelerate their careers in technology or start their own businesses.

Northwestern Kellogg MBAi: This is a joint degree between Kellogg and the McCormick School of Engineering. Graduates will be prepared for careers in tech operations, analytics, and innovation leadership.

Foster School of Business Technology Management MBA: This is an 18-month work-compatible MBA conferred by the Foster School of Business, and is designed to prepare graduates to accelerate or re-direct their careers, or to start their own businesses.

IE Business School Tech MBA: This is a one-year MBA conferred by the IE Business School. It is designed for students who want to develop their career in the technology sector or in tech-centric job roles, and who seek to become fluent in the language of business and technology.

In addition to the Tech MBA program options, many schools are integrating technology tracks into their full-time, two-year MBA programs. Fordham University’s Gabelli School of Business has created a secondary concentration in blockchain, and Georgetown’s McDonough School of Business now offers a handful of classes in fintech and crypto. And this trend is just getting started. Recently, several elite schools have announced incoming investments earmarked for building out technology initiatives. The USC Marshall School of Business received a $5 million gift to establish the Digital Assets Initiative, which will establish new curriculums and research opportunities in cryptocurrency, NFTs, and blockchain. Similarly, Harvard Business School is establishing the “D3” Institute to promote collaboration and research in digital and technology, data science, artificial intelligence and machine learning, and design thinking. And University of Pennsylvania’s Wharton School recently received an anonymous $5 million donation (in bitcoin) that will support the Stevens Center for Innovation in Finance, which focuses on fintech research and education.